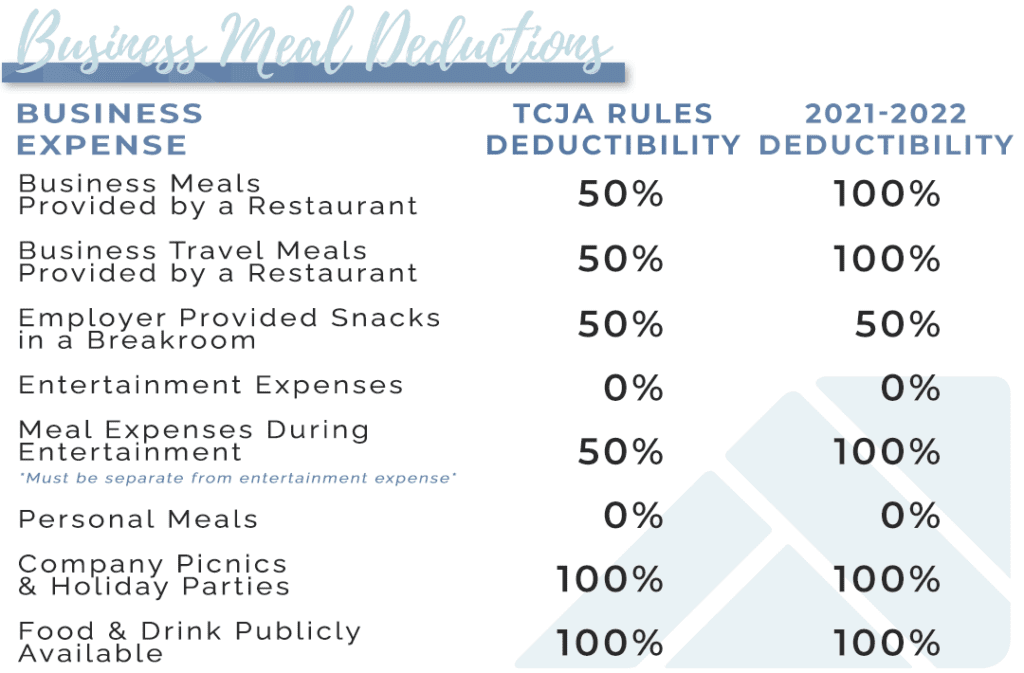

2025 Meals 100 Deductible. Prior to 2025, taxpayers could deduct 50% of their meal expenses incurred. Meals at a conference (50%) food for company holiday parties (100%) food and beverages given to the public (100%) dinner for employees working late at the office.

Cover with plastic wrap, slightly venting to allow. Employee shift meals remain 100% deductible for tax purposes.

100 Deduction for Business Meals in 2025 and 2025 Alloy Silverstein, 50% deductible (100% for tax years 2025 and 2025) food for charitable causes. The meal is eaten while the employee is away from home and their regular place of business.

NEW Business Meals 100 DEDUCTIBLE Learn How to Qualify YouTube, The deductibility of meals is changing as part of the consolidated appropriations act signed into law december 2025. Here are some examples of 100% deductible meals and entertainment expenses:

Are You Saving Your 100 Deductible Meal Receipts? MLP Accounting and, In general, travel meals are 100% deductible in 2025 if they meet the following criteria: {write_off_block} keeping records for your business meals.

TAX TIP MAKE MEALS 100 DEDUCTIBLE! YouTube, Meal expenses incurred by a taxpayer are deductible only if the expenses satisfy the following strict requirements imposed by the code: The 100% deduction on certain business meals expenses as amended under the taxpayer.

Limited Time Only Meals 100 Tax Deductible YouTube, For tax years 2025 and 2025, all business meals were 100%. Important tax guidance was released in late december 2018 that is considered to.

100 Low Budget Meals Anyone Will Love Every Day, What types of meal and entertainment expenses are 100% deductible on a business return? As part of the consolidated appropriations act signed into law on december 27, 2025, the deductibility of meals is changing.

NEW Business Meals are NOW 100 Tax Deductible in 2025! YouTube, 2025 meals and entertainment deduction. It's good to keep records of your business meals in.

Maximizing Your Meal budget While Traveling with a 100 Deductible, As a business owner, the easiest way to. It was increased in the.

Meals & Entertainment Deductions for 2025 & 2025, The change to the meal deduction could cause some confusion since meals were 100% deductible in 2025 and. Food and beverages were 100% deductible if purchased from a restaurant in 2025 and 2025.

Do you know some of the business meals are 100 deductible?, 2025 meals and entertainment deduction. Meals and entertainment deductions in 2025.

When it comes to claiming 100% deductions for certain types of meals in 2025, the ability to prove the validity of these claims is just as vital as the meal and the related business.